Mammen Mappillai Freed After Confession and Apology

Post Covid period,we will see many banks in the world in crisis,and many bank mergers. In 1938, the Travancore National & Quilon Bank was liquidated. It had been the fourth largest bank after a merger of two banks in 1937-Travancore National Bank (TNB) and Quilon Bank. TNB was established in 1912 by K.C. Mammen Mappillai in Thiruvalla. Mappillai was a member of the prominent Kandathil Christian family which founded around 15 banks. His family also founded the Malayala Manorama group and the MRF. One of the founders was a priest who had some experience with running chits.

People in the family blame Sir C P Ramaswamy Iyer, Dewan of Travancvore for the liquidation. But a closer look will reveal that the two families that ran the two banks, were in a rivalry inside the merged entity. The family feud gave Sir C P the chance to settle political scores. Obviously, it was because Mammen Mappilai had his own political ambitions. There was no need for Sir C P to learn politics from him-Sir C P was Secretary of the Indian National Congress in 1917. But Mappillai with few like minded Christians like T M Varghese, Barrister George Joseph and M M Varkey, had thwarted a move by the Travancore Government to merge Thangassery near Kollam into the State. Thangassery, like Anchu Thengu near Attingal, was part of British India and the ones who took part in the Abstention movement led by Christians then were hiding safely in these two places. Sir C P was then the Constitutional Advisor of the King; not the Dewan.

Let us go to the brasstacks.

TNB’s paid-up capital rose from Rs13,000 in 1912 to over Rs11.6 lakh in 1936. The reserve fund in 1936 was as high as 30% of the paid-up capital. Deposits rose from Rs3.75 lakh in 1922 to Rs177.65 lakh, a 60-fold increase in a 24-year period.

Quilon Bank was established by another Syrian Christian, C. P Mathen in 1919 with a paid-up capital of Rs 56,000. It rose to Rs 11.79 lakh in 1936. Deposits rose from Rs 54,000 in 1919 to Rs 102.57 lakh in 1936, about 190-fold increase in 17 years. In 1936, the reserve fund was nearly 17%of the paid-up capital, and there were 36 branches including three in what was then Ceylon.

Both Mappillai's and Mathen's fathers had earlier partnered in a bank named Thayyil Bank.Both Mappilai and Mathen had started the New Guardian of India Life Insurance Company in 1934.

In 1937 both these banks merged to form TNQ. The merged TNQ Bank became the fourth largest Indian bank at that time after Imperial Bank, Central Bank of India and Bank of India. It had 75 branches spread over the country with the Central Office at Madras and the Registered Office in Travancore.

The honeymoon lasted barely a year as the bank wound up under court order in August 1938. Charged with breach of trust and misappropriation, the directors were arrested. In a trial where the defence was impeded at every step, the Directors were found guilty and sent to prison.Both Mappillai, Mathen, Mappilai's brother K V Varghese and Mappilai's son K M Eapen were sent to prison in 1939. Mappilai familywas released in 1941 and Mathen in 1942. Mappillai had tendered a written apology to facilitate the release. Mammen Mappilai didn't go to the jail as a freedom fighter; he went there as a fraudster. Mammen Mappillai’s brother K C Eapen died in prison.

Matthen was born into a landed Christian family in central Travancore, in Kavumbhagom, Thiruvalla. He went to Madras after high school and did his Bachelor of History degree at Madras Christian College. He completed his education with a Bachelor of Law. He founded the Bank at 29.

He resigned his Headmastership in 1908 and took over the publishing of Manorama as full time job. Along with publishing he went into a number of business projects some of which never saw the light of Day. Shipping, Road Transport, Retail Shop, Book Publications etc. were some of them. However, he gave Kerala's economy a new bounce. He used Malayala Manorama to popularise cultivation, particularly rubber, the MONEY TREE from Brazil. Rubber eventually became backbone of Kerala midlands and continues to be so.

He was a member of the Modern Legislative Assembly of the erstwhile State of Travancore.

Most of the banks then, including TNB, mobilized most of their deposits and earned profits via chit funds. The bank’s financials were vulnerable to certain shocks. Which is the case for most bank failures.This happened in the case of TNQ Bank too.

Mammen and Matthen's success in insurance company together led them to amalgamate their respective banks in 1937. The registered office remained at the Quilon Bank headquarters in Travancore but the main business of the bank was conducted from its central office in Madras where its primary shareholders were based. Sir CP Ramaswami Iyer encouraged this arrangement by offering to place Rs 7,000,000 of Travancore treasury money with the merged bank but this offer was never fulfilled. He made the offer to keep the bank in the Travancore soil,since Mappilai and Mathen had planned to register it at Madras.

TN&Q Bank was established in 1937 with a new Quilon headquarters building which Matthen built at a cost of Rs. 140,000 (a very large sum of money at that time). To retain the business and deposits of the Travancore State, Matthen and Mammen had not only agreed to the headquarters in Travancore but that two of the bank’s directors were the Dewan’s appointees and also that the Bank’s General Manager, a confidant of the Dewan named K. S. Ramanujam, was appointed at the specific recommendation of Sir CP.All this was done,when the duo had a cordial relationship with the Dewan.

The bank’s financial run concluded with 88% of the public’s deposits being returned by the bank, and the bank becoming insolvent. At this point,Travancore administration demanded the extradition of Matthen and Mammen from Madras Presidency to Travancore State to stand trial for defrauding the public. Sir CP convinced the British Government in Madras that the bank and its directors had been financing the Congress party so appeals to the Madras High Court and the Privy Council in London to stay the extradition orders were rejected and 3 directors of the bank including Matthen, Mammen and Mammen’s elder brother K V Varghese and Mammen’s son K M Eapen, were transported in chains from Madras to Quilon to stand trial.

U P Kukkiliya, advisor to the liquidators,became a judge of the Highcourt;he also got the 225 acre cashew estate of P V Swaminathan, which was pledged with the bank as collateral. He got it free.

K. S. Ramanujam vanished abroad after the trial. Sir C P sent word to Mammen and Matthen that if they admitted their accused guilt and sought the Maharaja’s mercy they could be pardoned. Mammen and his son agreed to sign the declaration but Matthen continued to refuse. Sir CP initially declined to agree to the release without all of three of them admitting guilt, but finally released Mammen and his son on receiving their written confessions.They confessed that only they are responsible for the fall of the bank.

Matthen continued to hold out on his refusal to sign the confession, despite heavy pressure brought on him through the Inspector General of Police, Mr Abdul Karim, visiting him regularly in jail and suggesting that he sign a letter – which the IG had drafted, requesting the Maharaja to pardon and release him.Mrs Mathen approached the British advovate general B L Mirett with all the records,and he wrote a report absolving Mathen. It was sent to the Viceroy Linlithgow ( 1936-1943).

In these circumstances,finally, on 22nd January 1942, C. P. Matthen was unconditionally released by the Maharaja's Government without any written or verbal admission of guilt. The IG, Abdul Karim, took Matthen in his official car from Travancore jail to his house where his family had waited patiently for his release from jail. Thus,Matthen's position remained opposite to that of Mammen and family,exposing the separation and betrayal.He wrote his memoirs in 1951, called I Have Borne Much.

He died on 2 June 1960 in Paris, Île-de-France, France and buried at Thiruvalla.

Records prove the bank’s financials were vulnerable to certain shocks. Secondly,the Bank promoters alleged that the entity was brought to a grinding halt by C.P. Ramaswami Iyer, the powerful Dewan of the State of Travancore.

What turned Sir C P against the Bank was Mappilai's political ambitions. Sir C P's job was to serve the interests of the Travancore royal family, by destroying financiers of rival political agitations. Mappilai and the Bank were such financiers. K.G. Vijayalekshmy in the book Educational Development in South India (1993) highlights how the relationship between the bank and the government were strained. The emblem of the bank was similar to that of the Travancore coat-of-arms and despite requests to change the same, the bank insisted on the status quo. The Abstention movement in Kerala was started to secure adequate representation for the Ezhavas, Christians and Muslims in the state legislature. In 1938,when the Travancore State Congress was formed, it allied with the movement. The Dewan found TNQ Bank supporting the State Congress.The Indian National Congress was not there in Travancore.

Till today the Congress in Kerala is dominated by the christians-years later Malayala Manorama sided with the A K Antony-Oommen Chandy faction in the Congress to oust the Hindu Chief Minister, K Karunakaran.

What turned Sir C P against the Bank was Mappilai's political ambitions. Sir C P's job was to serve the interests of the Travancore royal family, by destroying financiers of rival political agitations. Mappilai and the Bank were such financiers. K.G. Vijayalekshmy in the book Educational Development in South India (1993) highlights how the relationship between the bank and the government were strained. The emblem of the bank was similar to that of the Travancore coat-of-arms and despite requests to change the same, the bank insisted on the status quo. The Abstention movement in Kerala was started to secure adequate representation for the Ezhavas, Christians and Muslims in the state legislature. In 1938,when the Travancore State Congress was formed, it allied with the movement. The Dewan found TNQ Bank supporting the State Congress.The Indian National Congress was not there in Travancore.

Till today the Congress in Kerala is dominated by the christians-years later Malayala Manorama sided with the A K Antony-Oommen Chandy faction in the Congress to oust the Hindu Chief Minister, K Karunakaran.

|

| Directors of Travancore National and Quilon bank with Sir CP -C.P. Mathen (MD), K. C. Mammen Mappillai, M. O. Thomas Vakkel Modisseril(Director) |

The argument of Mammen Mappillai in his autobiography, is echoed by his son, K M Mathew, in his autobiography, The Eighth Ring:

Sir C P managed to force a run on TNQ Bank branches in Madras. In March 1938, pamphlets were distributed in Madras revealing that TNQ bank was run by thieves and plunders. Most of these were printed at the Trivandrum Government Press.The Mylapore branch of the bank was chosen to orchestrate the run as it had the most deposits and most depositors lived locally. The run soon spread to other parts of Madras city and then to other regions in the Madras Presidency. K.S. Ramanujam, who was the general manager of the bank, was planted by the Dewan to destroy it.K M Mathew noted how the promoters of the bank tried to save the bank by appealing to different set of authorities including C. Rajagopalachari. Rajaji told them to appeal to the Dewan instead!

Sir C P managed to force a run on TNQ Bank branches in Madras. In March 1938, pamphlets were distributed in Madras revealing that TNQ bank was run by thieves and plunders. Most of these were printed at the Trivandrum Government Press.The Mylapore branch of the bank was chosen to orchestrate the run as it had the most deposits and most depositors lived locally. The run soon spread to other parts of Madras city and then to other regions in the Madras Presidency. K.S. Ramanujam, who was the general manager of the bank, was planted by the Dewan to destroy it.K M Mathew noted how the promoters of the bank tried to save the bank by appealing to different set of authorities including C. Rajagopalachari. Rajaji told them to appeal to the Dewan instead!

Both KM Mathew and CP Mathen,in their own respective accounts of the incident,allege that the liquidator, a former Imperial Bank and Reserve Bank official, was also planted with the connivance of the Dewan of Travancore, and that he disposed of the bank’s assets at throwaway prices far below their market value.

C.P. Mathen’s wife, Eliamma Mathen, On 26 August 1938, wrote in her diary: "Grave troubles in Travancore. Civil disobedience begins today. Lord be Thou with the leaders. Let thy will be done in everything. Perfect Thou the leaders in everything. Let them not be found wanting in anything. Psalm 73 is very apt for today. It foretells C.P.’s fall."

C.P. Mathen’s wife, Eliamma Mathen, On 26 August 1938, wrote in her diary: "Grave troubles in Travancore. Civil disobedience begins today. Lord be Thou with the leaders. Let thy will be done in everything. Perfect Thou the leaders in everything. Let them not be found wanting in anything. Psalm 73 is very apt for today. It foretells C.P.’s fall."

Mathen's grand daughter Mariam is married to N Ram of The Hindu.

|

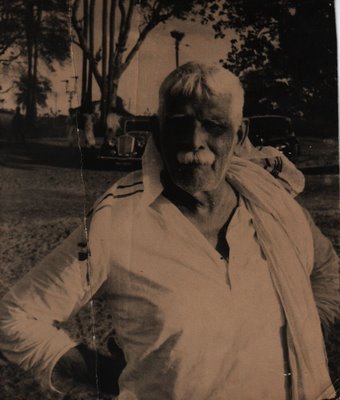

| Mammen Mappilai |

Those were the colonial times and one should remember that with all his power and influence,Sir C P was only the Dewan of a princely state; he had no jurisdiction over the Reserve Bank, that assessed the financial position of the TNQ Bank and decided on the liquidation.

The central bank was established amidst multiple failures and was supposed to stabilise the banking system.The central bank facilitated the merger by giving it a large credit line at the start. In its first History Volume (1935-51), RBI discusses the events:

What has not been much discussed in the context of the bank failure is the rivalry between the two groups which controlled the two banks which merged to form the TNQB. In KM Mathew’s Eighth Ring, there is a hint that all was not well.

In his biography of Sir CP, A Raghu, however, takes another view of the TNQB affair, different from that of the Mammen-Mathen group. According to Raghu, it is worthy of “a Hollywood thriller”.

The central bank was established amidst multiple failures and was supposed to stabilise the banking system.The central bank facilitated the merger by giving it a large credit line at the start. In its first History Volume (1935-51), RBI discusses the events:

- First week of June, 1938: TNQ Bank approached RBI to provide financial assistance to the bank. RBI agreed on the conditions that assistance will be provided only after detailed investigation of the bank’s financial position.

- 20 June: RBI asksed TNQ Bank’s auditors to investigate the books as per RBI norms. On the same day TNQ Bank asked the auditors to stop investigation as RBI was not providing any help.

- 21 June: TNQ Bank suspended payment.

- 22 June: Court proceedings to wind up start in Quilon and Bombay.

- 23 June: Winding up request presented at Madras.

- 27 -29 June: Madras Government meets RBI officials to address the continued unrest. TNQ Bank agreed to the Government suggestion that it gets its books investigated by RBI (again) to understand how much depositors could be paid etc. RBI estimates auditing expenses worth Rs10,000.

- 2 July: TNQ Bank approached the Madras high court to release Rs10,000 against the assets of the bank. The court refused the request citing it had no such approval powers. It asked RBI to take up the investigation assuring costs will be paid later.

- 8 July: RBI special officer investigated the books and finds that the bank was in a worse position than reported. It had exhausted all the realisable securities during the run, its balance sheet was incorrect, the bank was buying its own shares presumably with a view to keeping up their market value; and had loaned to directors and other interested parties on inadequate security, etc.

- 18-20 July: RBI Deputy governor Manilal Nanavati in Madras

- 28 July: The Deputy governor wrote to the government saying best option was to let liquidation continue.

- 9 August: This letter published in local press.The bank is ordered to be liquidated by the district court of Quilon.

- 5 September: The Madras high court could not take the orders of Travancore district court. Thus, it issued its own winding-up order.

- 21 March 1955: The above jurisdictional tangle led to a dragging on of liquidation proceedings. The bulk of the deposits were in British India, but loans in Indian princely states leading to further complications. The liquidation finally completed 17 years later in 1955.

|

| C P Mathen |

As regards financial help from the Reserve Bank, one should realize that these were pre-BR Act days (the Banking Regulation Act came in 1949) and, therefore, any prudent central banker who has read his Lombard Street (By Bagehot) would have had to ensure that the bank is solvent before coming forward with assistance. The bank did not initially cooperate, for reasons best known to itself, and later did so only on court orders. BR Act, incidentally, was occasioned more by the failure of around 700 banks during the Second World War (on which, see a mention in a speech by Sir Benegal Rama Rau, the second Indian and longest serving Governor of the Reserve Bank) and after, and the interesting case of “missing banks” in West Bengal, rather than by that of TNQB.

What has not been much discussed in the context of the bank failure is the rivalry between the two groups which controlled the two banks which merged to form the TNQB. In KM Mathew’s Eighth Ring, there is a hint that all was not well.

Puthupally Raghavan in the second volume of his five volume Viplava Smaranakal (Revolutionary Memoirs) remembers the jail days with Mappilai family and Mathen.Raghavan too has asserted that the TNQ Bank had financed the political agitations.He has said that the run happened because the depositors believed the Travancore government was going to withdraw its 75 lakh deposit,whereas the givernment had no deposit there.S Chattanatha Karayalar,a rich politician resigned as director of the Bank; V N Narayana Pillai resigned as director and legal advisor of the Bank.Another director Khaderboi too resigned.Karayalar became Chairman of the State Credit Bank,and Pillai government Pleader.

Raghavan was imprisoned on 7 February 1939, after a political murder.

According to him, Mappilai, Mathen and others were brought to the jail on 5 April, 1039.They were arrested in Madras on 20 October 1938.Their journey to the Central jail in Poojapura got delayed because of the case they fought against extradition.On 4 April,1039 a British army Sergeant escorted them in the Trivandrum Express.At Shenkottai, theTravancore police waited to take and parade them to Trivandrum.But the British Sergeant refused to hand them over.He escorted them to the jail.They arrived by 8 pm and were sent to a segregated cell.Mappilai was 66.

Within days of their arrival, Bank's deputy Chairman and Mappilai's younger brother K C Eapen alongwith K S Ramanujam surrendered in jail.Though very sick,K C Eapen wanted to spent his days with the family in jail.

The trial began in the second week of August.The trial was completed within two weeks and the case committed to the Sessions court. Sessions trial began on 18 September and it was over in four months time. The verdict came on 4 January 1940. Mappillai, Mathen,K C Eapen and K M Eapen were sentenced to eight years rigorous imprisonment. Ramanujam, who turned approver, was exonerated and given a reward of Rs 30,000.

The Higcourt dismissed the appeal filed by the convicts.Mappilai and the group were shifted from the segregation cell to the common jail. Mappilai and younger brother K C Eapen were in separate cells in the civil ward close to the main gate;Mathen in the fourth cell, K M Eapen and Varghese in another one. All of them had fetters on the left leg.

Within a short span of time,the condition of the asthmatic K C Eapen became worse.His end came on a night and dead body was removed only after six hours,when the lock up got opened in the morning. Mappillai in the adjoining cell,listened to hapless moans in the adjoining cell. A book on him, Jayilile Valyappan ( The Grandpa in Jail ), mentions the inner squabbles within the families.Son of Thayyil Appan and Thayyil Kandathil Mariyamma, K C Eapen died a broken man.

While the blame for the TNQ Bank's fall was put by the Christian lobby on the shoulders of Sir CP, another Christian bank,Palai Central Bank got liquidated without him-it is another story. Stories of the two banks should be read together for the complete picture.

© Ramachandran